WTI Midland: The world’s most important grade

A key feature that has transformed global oil markets over the past decade has undoubtedly been the rise of US crude exports, supported by the rapid y-o-y growth of US Permian supply (see: Fig. 1), anchoring the US as a key source of marginal supply to global oil markets.

Fig. 1: US crude production by play (m b/d)

Source: REA, EIA

Since the lifting of the US crude export ban in 2015, US crude exports have grown by around 3.5m b/d, with exports this year averaging around 4.3m b/d. In 2023 alone, Europe accounted for around 47% of these exports while Asia accounted for around 43%. REA expects US crude exports to grow even further out to 2030, with exports set to reach almost 6m b/d by 2030.

Fig. 2: US crude exports (kb/d) Fig. 3: US Crude exports by destination (%)

Source: REA, EIA, KPLER

Enter Midland

As US crude exports have grown, WTI Midland (API: 40-44, 0.2% S) – a light sweet crude – has emerged as the world’s largest freely traded grade by output and volume (see: Fig. 5).

Two factors have reinforced the importance of the grade: the dislocation in trade flows caused by the EU’s embargo on Russian crude has increased WTI Midland deliveries to Europe, effectively replacing Urals as a baseload grade for Northwest European (NWE) refiners (see: Fig. 4).

Fig 4: WTI Midland exports by trading region (kb/d)

Source: REA, KPLER

Fig. 5: 2024 average export volume of largest freely tradeable grades in oil market (kb/d)*

Source: REA, KPLER *freely traded means not subject to destination restrictions (e.g. Basrah Medium/Arab Light) and/or embargoes/sanctions (e.g. Russian Urals).

Second, the inclusion of WTI Midland in the Brent complex has further highlighted the role played by Midland, elevating the position of the US Gulf Coast (USGC) as a key centre for global oil pricing.

In May 2023, WTI Midland was added to the Platts Dated Brent MOC, allowing delivery of the grade into Brent to boost the physical liquidity of the benchmark after fears of losing its pre-eminent role in pricing more than 70% of global seaborne volumes. More than a year since WTI Midland’s inclusion, the effect has been felt: the number of cargoes moving into the Brent delivery “chains” (i.e. the process of converting physical forward contracts in the “cash” market to prompt cargoes) have grown.

Before the inclusion of Midland, around 8-10 cargoes per month were delivered into the Platts Dated Brent MOC window – since May 23, that number has doubled. So has the number of newer players trading in the Dated MOC window, including Saudi Aramco, Reliance, Oxy, and P66. This has meant that the pricing ecosystem around Midland crude has now become more relevant than ever, further reinforced by the fact that since May 23, WTI Midland has been setting the price of Dated Brent 50-60% of the time (see: Fig.6).

Fig. 6: Share of grades defining Dated Brent (%)

Source: REA, S&P Global Commodity Insights

In addition, WTI Midland has replaced the role once played by West Africa (WAF) crude as the global swing barrel between the Atlantic Basin and Asia. The underperformance of Africa’s upstream in recent years and the expansion of its downstream industry (e.g. Dangote, which incidentally is currently feeding on a diet of WTI Midland) reinforces this trend.

Beyond Cushing

As the USGC has grown in importance, so have the trading tools to manage price risk. Traditionally, US crude pricing has been dominated by CME’s NYMEX WTI contract, which has Cushing as its physical delivery point.

Despite NYMEX WTI’s benefit of enjoying pricing incumbency (and strong liquidity), two major shortcomings exist: 1) Cushing as a delivery point suffers from storage constraints, increasing price volatility and hedging risk. Second, Midland-origin crude quality remains misaligned with the crude specifications of the NYMEX WTI contract. NYMEX WTI crude remains more representative of Domestic Sweet Crude (DSW), rather than Midland-origin crude supply.

This is why the Argus outright Midland price is based on a differential to the NYMEX settlement price (Argus outright Midland = NYMEX Cushing settlement price ± Argus diff at Midland). The risk is that the infrastructural limitations at Cushing, misalignment between Platts-approved Midland quality and the pricing location could increase hedging cost, or worse, lead to a significant basis risk exposure.

Table One: NYMEX, Platts WTI Midland and ICE Midland (HOU) quality specs

Source: REA

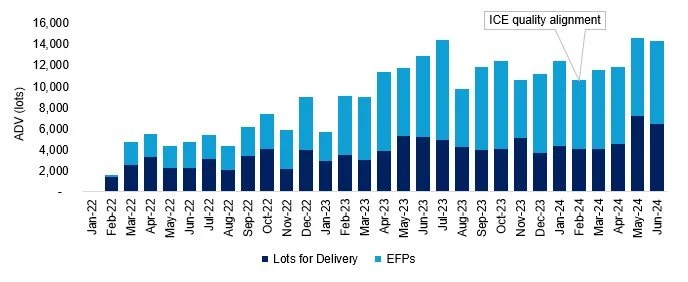

Against this backdrop, volumes have been growing on a relatively new contract launched by ICE (ICE Midland WTI crude futures contract: HOU), allowing participants to price and hedge around 4m b/d of Midland-origin crude, delivered to the USGC. Since WTI Midland’s inclusion, trading volume on the contract and OI has grown (see: Fig. 7), highlighting a key trend to watch over the coming years: the continuing growth in the role of the USGC as a key pricing centre for hedging and price risk management.

Fig. 7: ICE Midland WTI Gulf Coast futures, Average daily volume (LHS) and Open Interest (RHS)

Source: REA, ICE

In February this year, ICE further aligned the quality specs of the physical contract with the deliverable quality delivered into the Platts MOC. Enterprise EHSC and ONEOK Seabrook are the only two terminals on the USGC that guarantee the quality of Midland crude is both Platts and HOU compliant. Since the inclusion of Midland into Brent, around 60-65% of Midland cargoes have loaded from Houston terminals on the water, primarily EHSC and Seabrook, which are connected to the Enterprise ECHO and ONEOK MEH delivery locations for the ICE HOU contract.

Why does this matter? By aligning the Midland quality specs in line with Platts – and with Houston’s infrastructural flex only set to grow in importance as bottlenecks elsewhere become more challenging (e.g. Corpus) – US players going to expiry on the HOU contract can now be confident that the Midland barrel they receive is “on-spec” and aligned with the Midland used in the Platts MOC assessment. Unsurprisingly, since the ICE-Platts Midland quality alignment, physical deliveries on the contract have grown (see: Fig. 8).

Fig. 8: ICE Midland WTI physical deliveries & EFPs

Source: REA, ICE

Asia and the role of WTI Midland

How is Asia responding to the inclusion of WTI Midland into Brent? One of the key trends over the past few years has been Asia’s growing exposure to the US crude pricing ecosystem. This has mirrored the region’s transition from a term-contract driven marketplace to one fuelled by more spot trading activity and new price-discovery tools. Several trends have supported this, particularly:

§ The growth of destination-free barrels trading in the spot market: at no other time has there been such a wide pool of spot volume for Asian players, a trend turbocharged by ADNOC’s decision to remove destination restrictions on all its crudes in 2021, in conjunction with the launch of the Ice Futures Abu Dhabi (IFAD) Murban crude futures contract. Other liquid destination-free streams also exist in the region, including Oman Export Blend. In addition, players such as Taiwan’s Chinese Petroleum Corporation (CPC) now use destination-free Midland as a baseload, alongside other refiners in Asia (particularly South Korea and to a lesser extent, India). The dislocation caused by the Russia-Ukraine conflict has diverted almost all Urals to the Asian market (see: Fig. 9), highlighting the growth of delivered pricing in the region.

Fig. 9: Urals crude exports by region (kb/d) Fig. 10: WTI Midland inflows to Asia by country (kb/d)

Source: REA, KPLER

§ The growth of derivative instruments to manage the shifts in term/spot trading in Asia: the past several years has seen a massive increase in derivatives volume in East of Suez markets, including not only volume traded in the ICE Dubai swaps market (supported by Russian flows to Asia) but also newly developed exchanges such as IFAD and older ones such as DME Oman. Liquidity has also been supported by the growing ecosystem of swap dealers, brokers, commercial banks and speculative traders entering Asia as trading houses optimise costs by setting up desks in Dubai and Singapore.

Currently, we see the following as key trends likely to emerge in Asia going forward:

1) Sweet-sour arb pricing and risk management will continue to be dominated by the Brent-Dubai Exchange of Futures for Swaps (EFS) – the key west-east market signal in the market and tool for rebalancing flows between the Atlantic Basin and Asia. For Asian refiners seeking to shifting their Brent exposure to a floating price against Dubai, the Brent-Dubai EFS is likely to remain the key tool for sweet-sour arbitrage price risk management.

2) More Asian trading firms are splitting their sweet and sour desks, with REA’s trading sources suggesting that there is a bigger push by Asian firms to manage marginal sweet inflows into Asia: The push by Asian players to manage WTI Midland inflows (taking some “book risk” away from Houston) signals the potential for new contracts to be used to manage WTI Midland inflows to Asia, and the potential for WTI Midland-Murban spread volume to grow (particularly given the similarities in quality and potential for basis risk to be reduced as all trades can be done on one platform).

3) Potential for new term deals involving WTI Midland to price against different contracts in the future: Asian term holders of WTI Midland have indicated that they may be looking to explore different contracts in the future to manage their price risk exposure to the USGC. Currently, Asian firms convert their WTI exposure using the Argus WTI Houston price assessment which is a differential to NYMEX WTI. However, this move was done prior to the inclusion of WTI Midland into the Dated Brent basket. Time will tell if other trading instruments are used, but the demand for simpler, more efficient, and more cost-effective USGC price risk management tools is certainly growing.

If you would like to learn more about REA’s Oil Service, please fill in the details below: